Shale Bonanza or Damp Squib for the UK?

Guest blogger Alan Tootill subjects the reports of hugely increased gas reserves to some scrutiny

Last week the British Geological Survey (BGS) produced a new estimate of how much gas there is in the shale rock under the North of England. This was hailed by the media as showing what an incredible resource we had beneath our feet.

Press reports varied in their guesswork as to how much we can get out and how many years of UK gas use this meant. These latter ranged from 40 years to a definitely incredible 141 years according to the Mail on Sunday.

Everybody agreed this was an opportunity we could not ignore.

How realistic are the figures and what are the consequences of the BGS estimate? In this article we hope to cast some light on the reality behind the hype.

1. The difference between resources, technically recoverable resources and reserves.

What BGS are talking about is the total resource – the amount of gas they estimate is in the rock. This is usually called gas in place, and is necessarily only an estimate. The BGS actually said the figure is probably between 822 trillion cubic feet (tcf) and 2,281 tcf, with a middle working estimate of 1,329 tcf. We’ll use that as our guideline – everybody else did.

The snag, of course, is that unconventional gas is not as easy to extract as gas from conventional sources – the US Energy Information Administration (EIA) says the difference is significant – around an order of magnitude. In other words you can only expect a tenth of what you can get from conventional gas fields.

In last week’s reports we had various estimates of the “recovery factor”. You might expect it to mean what percentage of gas in place we can get out. You’d be right, but it’s more complicated than that. How come Cuadrilla’s Francis Egan is talking about hoping to get 10%, when the Mail, for example, tells us that the US experience is 18% and “experts” say that between 20% and 30% is possible as a recovery factor?

We say the studies have shown that in the US the average recovery factor is something like 6.7%.

Why is there this big discrepancy?

The Mail probably got its figures from the recent Institute of directors (IoD) report which was packed with questionable information. Some of it was about recovery factors. They quoted three studies. The first wasn’t a study at all but a web article which said US recovery factors average 18%. The second estimate was from the International Energy Agency which said that most recovery factors were less than 15%. Naturally enough the Mail ignored that one. The third report was from MIT that said recovery factors were between 15 and 30%. (And of course it was this 30% figure that the Mail seized on to boast we could get 141 years of gas).

In October 2012 BGS evidence given to the Select Committee on Energy and Climate Change said recovery rates were typically around 10% in the US.

The Oil and Gas journal produced a report in March 2012 using data from the EIA, the US Geological Survey USGS and producer estimates, which suggested the recovery factor in five major US plays was – Barnett 5.8%, Fayetteville 9.6%, Haynesville 4.74%, Marcellus 5.6%, and Woodford 6.67% – average 5.5%.

So what’s going wrong with the figures?

A prime reason is they are using the term “recovery factor” in different ways.

The boasts of high recovery factors are not talking about what is in reality likely to be produced. They are talking about “Technically Recoverable Reserves”. This is a term which estimates how much of gas in place can feasibly be extracted by current technology.

The low estimates are using a recovery factor to describe the percentage of gas in place which it is economic and practical to extract – Reserves – and are normally based on a proven history to-date.

The difference is significant. Technically Recoverable Reserves ignores various factors like unacceptability of extracting on social grounds, and how economically the gas can be extracted. Naturally the “reserves” will be in practice far less than the TRR. For this reason both the IOD and the media are misleading the public in how much gas we could reasonably expect to see produced by fracking shale.

2.How many wells?

In order to judge what effect fracking would have on water resources, the countryside and the environment the next step is to consider how many wells are needed to extract a particular volume of gas.

This is calculated by using an estimate of the likely production of a well over its lifetime. This is the EUR – the Estimated Ultimate Recovery of a shale gas well.

Because shale gas exploitation is relatively new it is impossible to get any hard facts on this, as the life of a well may extend over 30 years. There simply is not the data, so any estimate of EUR has to be based on younger wells, and their production rates over a shorter period. Typically in the US experience a well might produce half its total output in the first five years, the other half dribbling out over the next 20 or 25.

As with recovery rates, we have to be wary of figures coming from the industry. In fact more so with EUR because these are what companies may use to attract investment.

In the UK we haven’t heard much yet about EUR, for a very good reason. That the figures from the US indicate a potential frightening number of wells needed to “unlock” the shale gas resources we are told are below our green fields.

The recent Institute of Directors report quoted five US gas fields and their EUR figures. The average was 3.16 bcf (billion cubic feet) of gas over the lifetime of a well. This was based on an industry consultant report.

For the same fields the recent (June 2013) EIA figures showed an average for these 5 fields (Barnett, Fayetteville, Haynesville, Marcellus and Eagle Ford) of 2.94 bcf.

However USGS figures for these fields stated an average of 1.42bcf. An Oil and Gas Journal report estimated 2.1bcf.

Over all US fields the EIA June 2013 figures show a raw average of 1.8bcf for EUR, or a weighted figure (by the size of the field – and large fields generally have higher figures than small fields) of 1.85.

Again we have a discrepancy in estimates, but this time there is no divergence because of terminology. The figures differ more this time because of methodology and the origin. The USGS estimates (2012) for the average US well over all fields was a mere 1.1 bcf. Whether you believe this is more accurate than EIA estimates driven by industry consultants or the UK IoD figures sponsored by the industry is your choice.

3. Putting the figures together.

A few calculations will show the number of wells that the North would have to endure to reach anywhere even close to the hyped forecasts.

Scenario 1.

The recovery factor to apply is the optimistic industry (Cuadrilla) estimate of 10%.

10% of the BGS 1329 tcf is 132.9 tcf. This in theory would give the equivalent of something like 40 years supply of gas at the UK’s current usage.

If each well can produce 3.16bcu over its (thirty year) lifetime then the calculation shows that the number of wells required would be 42,000.

Assuming that everywhere the Bowland Shale is thick enough to support three horizontals, with twelve vertical bores to a well pad this would mean around 1,167 well pads in the North of England.

This is the best possible case. In reality the average thickness of the shale is not as deep as Cuadrilla have experienced in the Fylde.

Scenario 2.

Still using the 10% recovery factor.

If the USGS figures are the guide, the number of wells (at 1.1 bcf over lifetime) required would be 120,800. This would require around 3,350 wellpads.

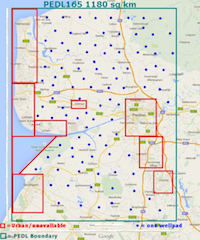

The area surveyed by the BGS report amounted to some 10,000 square miles. The shale deposits they show cover around (these are rough estimates, we didn’t find the figures in the BGS report) 5,000 square miles.

4. Scenarios 1 and 2 – Conclusion

For scenario 1, and the maximum possible horizontals per vertical wellbore, the number of pads would mean an average of around one pad per 4 square miles. On the basis that each lateral well would extend one mile, the footprint covered by a pad is around that same 4 square mile figure.

On this scenario almost every square inch of the area above the Bowland Shale deposits would be above a horizontally-drilled well. This is clearly absolutely impossible. The Bowland Shale lies below metropolitan and other build-up areas, not to mention environmentally sensitive areas.

The conclusion is that, even at a recovery factor of 10% , and at an optimistic rate of production, AND a thickness of shale which allows three horizontals per vertical (something that is relatively untried, even in the US, within one shale formation),no way is it feasible to exploit fully the Bowland resource.

The figures do not add up. The absurdity becomes more clear if we turn to scenario 2, with a lower EUR of 1.1 per well. There is simply no way that 3,350 well pads or more could squeeze into a 5,000 square mile area. The horizontals would be so short it would undermine even the 1.1 bcf assumption.

So clearly the 40 years of gas is an illusion.

It cannot and will not happen.