Spirit having flown …

Back in 2013 Centrica decided it would be a good idea to invest in the nascent UK shale industry.

The details when they came out revealed that they would pay:

£40,000,000 Paid Up front

£60,000,000 Initial Carry

£46,700,000 Contingent Carry payable after the flow testing of gas for six months

As far as we are aware they will have paid £100 million but as Cuadrilla have not flow tested the £46.7 million contingent carry will not have been triggered.

A name change and few earthquakes later (the arm of Centrica which invested is now called Spirit Energy) they have decided to cut their losses and walk away bruised by the experience.

AJ Lucas posted the following yesterday:

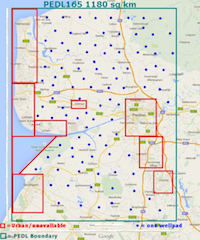

AJ Lucas limited (Lucas) has received notice from Spirit North Sea Gas Limited, its partner in the UK Bowland Shale exploration licence, that Spirit intends to exit the licence and transfer its 25% interest back to Lucas for a nominal sum.

This is in accordance with an option included in the 2013 Sale and Purchase agreement that Lucas negotiated with Centrica (a Parent Company of Spirit). The option allowed for the return of the 25% licence share for a nominal amount once Centrica had invested up to an agreed level in the licence.

That originally agreed level has in fact been surpassed by some margin. The move is part of a broader series of actions being taken by Centrica including an exit from the upstream oil and gas business and other wide-ranging organisational changes. This includes the proposed sale by Centrica of its interest in Spirit Energy which holds the 25% interest in the Bowland shale licence. The licence transfer will be subject to a number of pre-completion conditions, including UK Regulatory approval, and is not therefore expected to complete until the final quarter of 2020. Spirit will remain liable for its 25% share of the future decommissioning costs of the exploration wells already drilled and facilities already installed on the licences.

The UK shale gas industry might have looked like a good investment (to some) at 85p a therm, but since UK gas spot prices have fallen to below 40p a therm today the maths, based on forecast extraction prices in the UK, just don’t make any sense.

After Riverstone’s exit it looks like AJ Lucas have now lost another significant investor along with the promise of a further cash injection if they ever got to do that flow test.

At least Spirit are still legally committed to funding a share of the decommissioning costs. Hopefully that money will be spent in the near future.